Foreclosure Assistance in Birmingham

Understanding Foreclosure Challenges in Birmingham

Facing foreclosure in Birmingham can be overwhelming, but homeowners have options. Birmingham foreclosure assistance programs offer crucial support for those struggling with mortgage payments. Many residents facing housing crises in the Magic City turn to local property retention services for swift solutions.

Types of Foreclosure Prevention Resources

Birmingham foreclosure assistance comes in various forms, from housing counseling to legal aid. Magic City mortgage relief options often include:

- Loan modifications

- Refinancing opportunities

- Temporary payment suspensions

- Legal intervention strategies

Local Support and Intervention Programs

These resources in Jefferson County offer helpful information. They connect you with foreclosure prevention specialists. These experts can help you keep your home. Alabama foreclosure intervention programs frequently highlight the importance of acting quickly to explore all available alternatives.

Community Experiences and Success Stories

From Bessemer to Hoover, homeowners share experiences with Birmingham housing crisis support services. Testimonials emphasize the effectiveness of Jefferson County foreclosure alternatives in helping residents stay in their homes. These Alabama home saving resources highlight the peace of mind that comes from expert help. They guide you through the complex foreclosure prevention process.

Next Steps for Homeowners

Homeowners facing potential foreclosure are encouraged to:

- Contact local housing counselors

- Explore assistance programs

- Communicate with mortgage lenders

- Seek professional legal advice

Birmingham Foreclosure Resources

Facing Foreclosure in Birmingham? Here's Your LifelineAre you a homeowner in Birmingham, Alabama, struggling to keep up with your mortgage payments? You're not alone. The threat of foreclosure can be overwhelming, but there's hope. Let's explore the resources and options available to help you navigate this challenging situation.

Understanding Your Options

HUD-Approved Housing Counseling

Your first line of defense against foreclosure is seeking guidance from a HUD-approved housing counseling agency

These agencies offer free or low-cost advice tailored to your specific situation. They can help you understand the foreclosure process, explore alternatives, and communicate effectively with your lender.

Loan Modification

One potential solution is a loan modification. This involves working with your lender to adjust the terms of your mortgage, potentially lowering your monthly payments

.A successful modification could mean:

- Reduced interest rates

- Extended loan terms

- Principal forbearance

Refinancing Opportunities

If you have equity in your home, refinancing might be a viable option. This involves replacing your current mortgage with a new one, potentially with better terms

However, it's crucial to carefully consider the long-term implications of refinancing.

Legal Assistance and Rights

Finding Legal Help

Don't underestimate the importance of legal counsel. Many organizations in Birmingham offer free or low-cost legal aid to homeowners facing foreclosure

These experts can help you understand your rights and explore legal options to prevent foreclosure.

Alabama's Foreclosure Process

Understanding the foreclosure timeline in Alabama is crucial. Typically, the process involves:

- Notice of default

- Notice of sale

- Foreclosure auction

Knowing these steps can help you take timely action to protect your home

Alternative Solutions

Mediation

Some lenders offer mediation programs, allowing you to negotiate directly with them to find a mutually beneficial solution

This can be an effective way to avoid foreclosure and reach an agreement that works for both parties.

Bankruptcy as a Last Resort

While not ideal, filing for bankruptcy can temporarily halt the foreclosure process, giving you time to reorganize your finances

However, this should be considered only after exploring all other options.

Your Right of Redemption

Alabama law provides a unique "right of redemption," allowing homeowners to reclaim their property even after foreclosure sale

This right extends for one year after the sale, offering a final opportunity to save your home.

Taking Action

Remember, time is of the essence when facing foreclosure. The earlier you act, the more options you'll have. Don't hesitate to reach out to local resources and professionals who can guide you through this challenging time. By understanding your options and taking proactive steps, you can increase your chances of keeping your home or finding a solution that best fits your situation. Stay informed, seek help, and remember – you're not alone in this journey.

Imagine coming back to your rental property after a few weeks regarding renovations. You put your key in the lock, but it doesn’t turn. The locks are new. You knock, confused. A stranger opens the door, wearing your bathrobe, and tells you to get off their property. It sounds like a movie script, but for thousands of…

You found the perfect house. It has the correct number of bedrooms, a big backyard, and a school down the street. Then you look at the listing details and see the monthly cost you were not expecting. It is the HOA fee. For many first-time buyers, this acronym is a mystery. For others, it is…

Buying a home in 2026 is tough. Prices are high. Interest rates are tricky. You might be looking for a deal. That is where a fannie mae homepath property comes in. You may have heard the term thrown around by agents or investors. But what does it mean to you? In this guide, we will…

Buying a home feels like learning a new language sometimes. You see a house you love online, but the status says something confusing. It might be pending or under contract. You probably wonder if you can still make an offer. This is a very common frustration for buyers in 2025. The market moves fast, and…

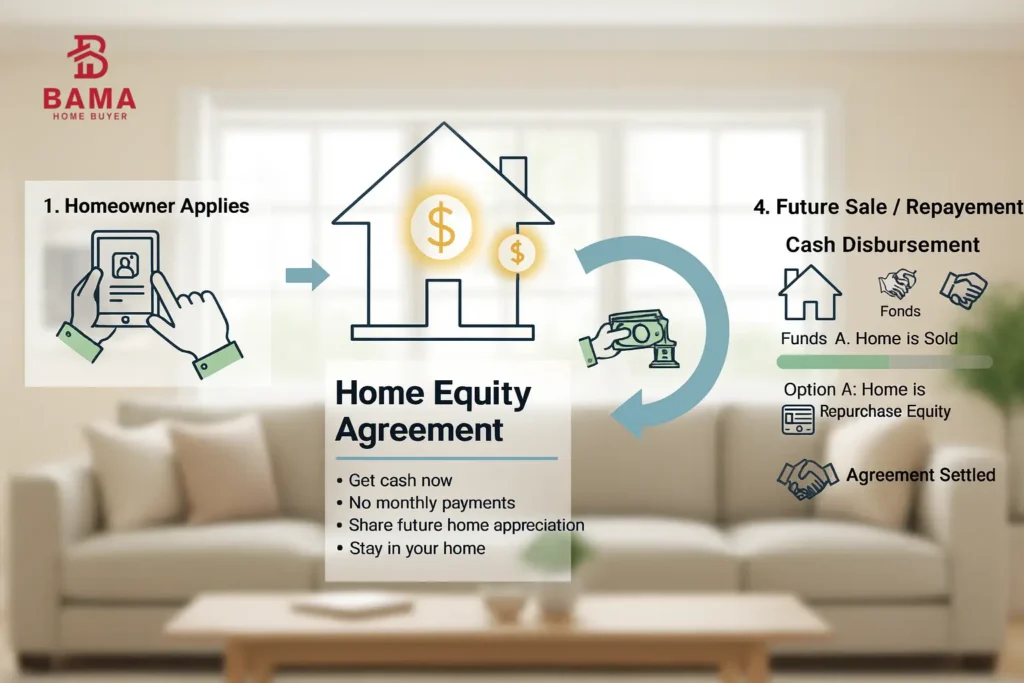

Owning a home feels great. You have your own space. You also have a valuable asset. Many people call this being house rich and cash poor. Your money is stuck inside the walls of your house. You might need that money for bills or repairs. Most people think they only have one choice. They think…

Buying a home is a huge step. It is often the biggest purchase you will ever make. Getting some money back sounds amazing. This is called a home buyer rebate. But what is it? How does it work? Is it even legal? In this guide, we will answer all your questions and explain everything. Let’s…

Feeling stuck with a house full of stuff? You are not alone. Selling a hoarder house can feel crushed. The task looks too big. The emotions are heavy, or you might look at the piles and think this is impossible. Who would ever want to buy this? It is a stressful situation. Many people face…

You see the signs everywhere. They are tacked to telephone poles. They pop up on your social media. “We Buy Houses Fast.” “Cash For Your Home in 7 Days.” “Any Condition, Any Situation.” These signs promise a quick, easy way out. If you need to sell your home fast, they sound perfect. No repairs. No…

Got a house that’s seen better days? You are not alone. Many people in Alabama own a house they need to sell. But selling it is not easy. This is especially true if the house is, well, ugly. You might be thinking, “who would ever want to buy this place?” You might feel stuck. Maybe…

Losing a loved one is hard. Dealing with their property afterward can feel even harder. You might be looking at a house full of memories and wondering, “What do I do now?” If you need to sell my probate house in Alabama, you’ve found the right guide. This process can seem scary. There are courts…