What Is a Home Equity Agreement and How Does It Work

Owning a home feels great. You have your own space. You also have a valuable asset. Many people call this being house rich and cash poor. Your money is stuck inside the walls of your house. You might need that money for bills or repairs. Most people think they only have one choice. They think they must take out a loan. There is another way to get cash. It is called a home equity agreement. This is not a loan. It is a partnership with an investor. You do not make monthly payments. This guide will explain everything you need to know. We will look at how this works and if it fits your needs.

Understanding the Basics of Home Equity

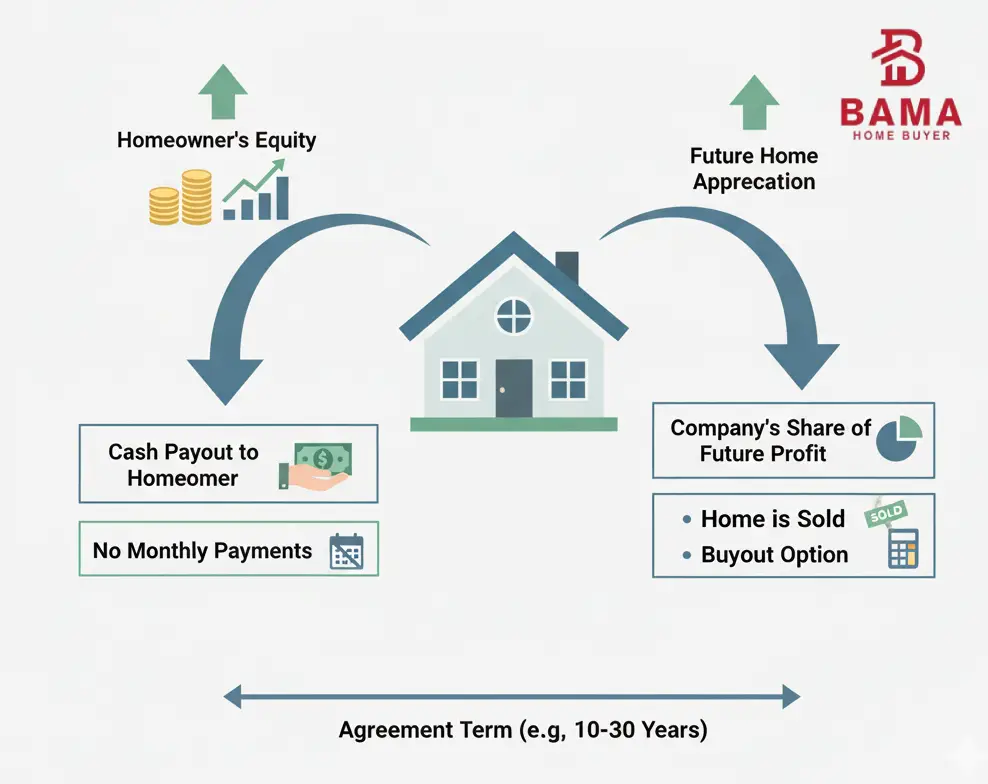

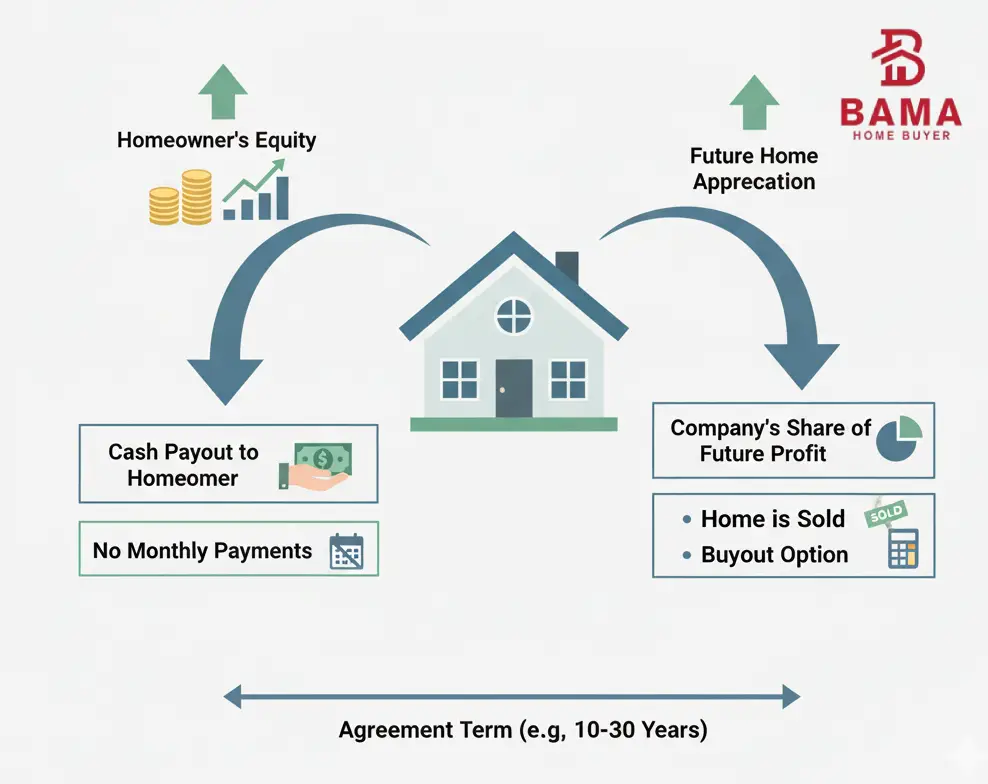

We need to define what is home equity before we dig deeper. Equity is the part of the house you truly own. You calculate this easily. Take the current value of your home. Subtract what you still owe the bank. The number left over is your equity. This money usually sits there until you sell. A home equity agreement lets you unlock that money now. You do not have to sell your house to get it. You also do not have to borrow money. You are selling a share of your future home value.

Investors give you cash today. In exchange, they get a piece of the profit later. This usually happens when you sell the home. It can also happen when the agreement term ends. This term can last ten years or even thirty years. You keep living in your house. You keep your title. You remain the owner. The investor just owns a silent piece of the potential growth.

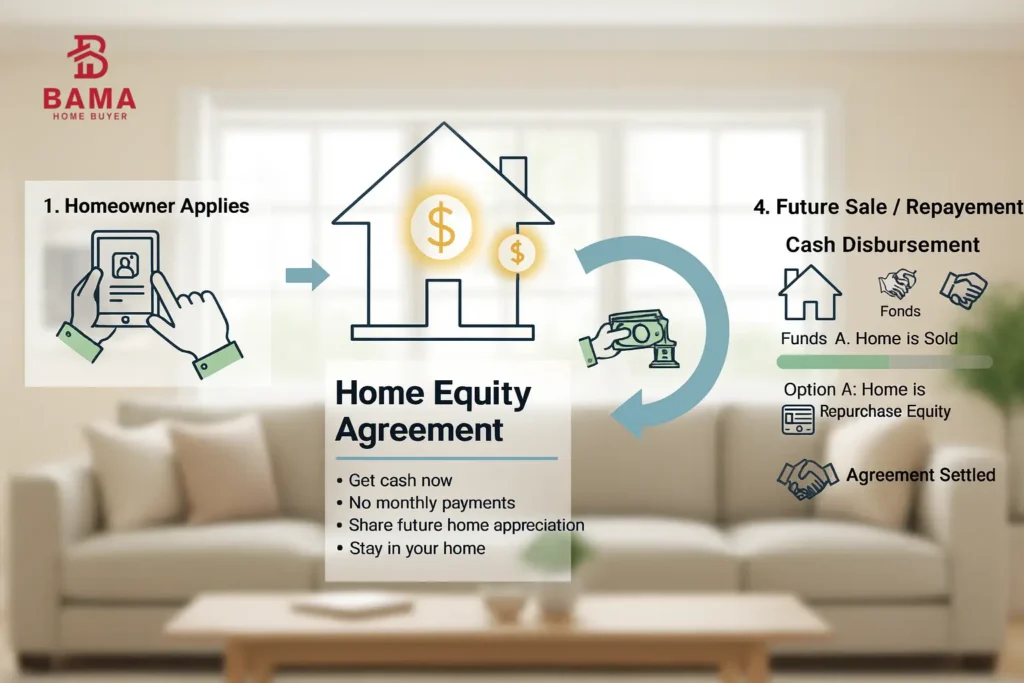

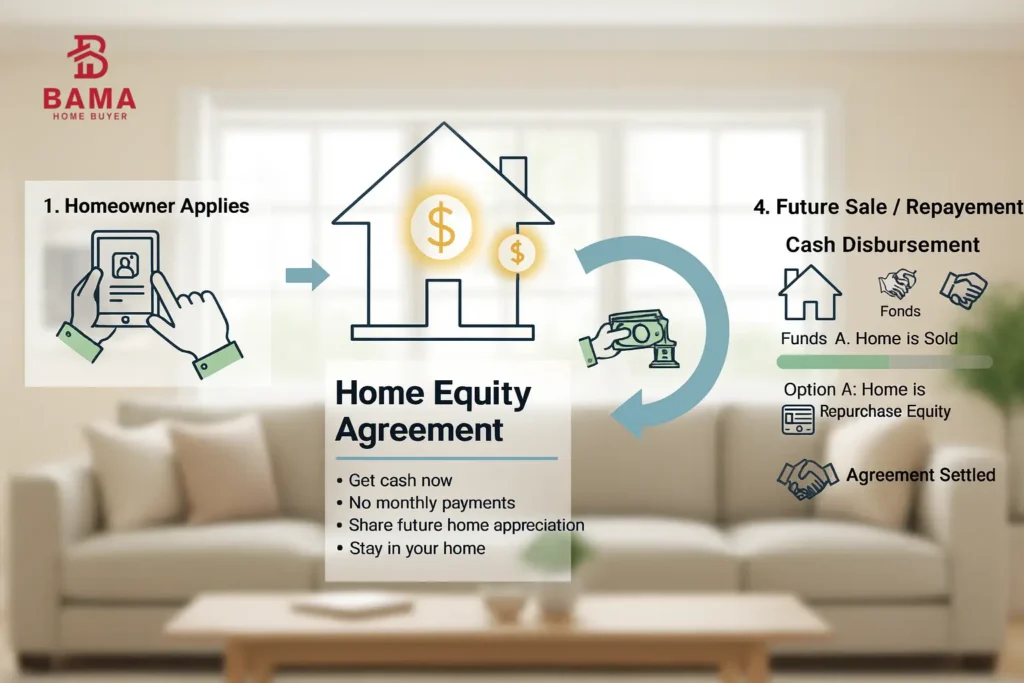

How Does a Home Equity Agreement Work?

The process is quite simple. It starts when you find a company that offers these agreements. You apply just like you would for other financial products. They look at your home value. They also look at your credit history. However, the credit check is often easier than a bank loan. They want to know your house is worth enough money.

Once you apply, they send an appraiser. This person decides what your home is worth right now. The investor then makes you an offer. They might offer you ten percent of your home value in cash. In return, you agree to pay them back later. You pay them the original amount plus a share of the growth. This is the core of how does a home equity agreement work.

You get the money in a lump sum. You can use it for anything. Some people pay off credit cards. Others fix up the house. You have no monthly bills to pay the investor. The balance grows until the end of the contract. At the end, you pay them back. You can do this by selling the house. You can also refinance or use savings to buy them out.

How to Get Equity Out of Your Home Without Refinancing?

Refinancing is expensive right now. Interest rates change all the time. Many homeowners have a low rate on their main mortgage. They do not want to lose that low rate. Refinancing replaces your old loan with a new one. This often means a higher interest rate. This scares many people away from accessing their cash.

A home equity agreement solves this problem perfectly. It sits on top of your current mortgage. You do not touch your primary loan. Your monthly house payments stay the same. This is the best way on how to get equity out of your home without refinancing. You get the cash you need. You keep your low interest rate on the main loan. It is a safe tool for preserving your current financial setup.

The Financial Mechanics of the Deal

You need to understand the math. This is an investment for the company. They are taking a risk on your property value. Because of this risk, they expect a return. Let us look at how does a home equity investment work with numbers. Imagine your home is worth very much money today. The investor gives you cash equal to ten percent of that value.

They might ask for twenty percent of the future value. This is the trade you make. You get cash now without payments. They get a bigger slice of the pie later. If your home value goes down, they might lose money. If your home value goes up, they make a profit. They share in the rising prices of real estate. You share the risk and the reward.

Analyzing Home Equity Agreement Pros and Cons

Every financial decision has good sides and bad sides. You must weigh the home equity agreement pros and cons carefully. The biggest pro is the cash flow. You get money without adding a monthly bill. This is huge for people on a fixed income. Retirees often love this option. It helps them live better without stress. Another pro is the qualification. You do not need perfect income verification like a standard bank loan requires.

The cons are also real. The cost can be high. If your home value skyrockets, you pay the investor a lot of money. You might end up paying more than a standard loan interest rate. Another con is the lien. The company puts a legal claim on your house. You cannot sell without paying them first. You also limit your full profit when you eventually sell. You are giving away a portion of your future wealth.

Comparing Debt vs Equity Options

You have other choices besides an agreement. You could get a home equity line of credit. This is often called a HELOC. You might ask about the benefits of home equity line products. A line of credit acts like a credit card. You borrow only what you need. You pay interest only on what you use. The rates are usually variable. This means your payment can go up.

You also have standard home equity loans. These are lump sum loans. You get all the cash at once. You make steady monthly payments. People often ask what are home equity loan rate averages. These rates are usually lower than credit cards. However, they are higher than first mortgages. An agreement has no rate because it is not a loan. You avoid the stress of tracking interest rates. You avoid the burden of a new bill arriving every thirty days.

Using Funds for Improvements

Many people use this money to make their house better. A home equity loan for home improvements is common. But an agreement works for this too. You fix the roof. You update the kitchen. You add a new bathroom. These fixes make the house worth more money.

This creates a win for everyone. The house value goes up. You get a nicer place to live. The investor is happy because the asset is worth more. Just remember that you share that increased value. You are using their money to increase the value they will share in later. It is a cycle that can work well if you plan it right.

Who Qualifies for These Agreements?

Banks can be strict. They want to see high income. They want low debt. Self-employed people often struggle with banks. Home equity agreements are different. The investors care most about the house. They want to know the property has value. They want to know you have enough equity built up.

You typically need at least twenty percent equity to start. Some companies require more. Your credit score matters less. A score of 620 is often enough. Sometimes even lower scores work. This opens doors for many families. If the bank said no, an agreement company might say yes. It provides access to capital when other doors are closed.

Location Matters in Real Estate

Real estate rules change from place to place. Some states have specific laws about these agreements. For example, a home equity agreement Florida resident might see different terms than someone in New York. Florida has high property values. This makes it a popular spot for these investors. The warm weather attracts buyers. This keeps prices stable or rising.

Investors like stable markets. They want to know the house will sell easily later. If you live in a popular area, you will have more choices. Rural areas might have fewer options. Companies prefer cities and suburbs. Always check which companies serve your specific zip code. Local rules will guide the final contract terms.

The End of the Agreement Term

You cannot keep the money forever without settling up. Every agreement has an end date. This is often ten or thirty years away. When that day comes, you must act. Most people sell the house. They use the sale money to pay the investor. Then they move to a new place.

You can also choose to stay. To do this, you must buy out the investor. You need to pay them their original cash plus their share of the growth. You might use savings for this. You might take out a new loan to cover it. If you are looking for a quick sale solution, companies like Bama Home Buyer can help you sell fast. Knowing your exit strategy is very important before you sign.

Is a Home Equity Agreement Right for You?

This product is not for everyone. It works best for specific situations. Ask yourself a few questions. Do you need cash right now? Do you hate the idea of monthly payments? Do you plan to move in the next ten years? If you answered yes, look closer at this option.

It is also good if you cannot get a normal loan. Maybe your income fluctuates. Maybe your credit took a hit recently. This agreement looks past those issues. It focuses on the asset. However, if you want to keep every penny of future profit, this is not for you. If you can afford a cheap bank loan, that might cost less in the long run.

Safety and Regulations

You might worry if this is safe. It is a legitimate financial product. However, it is less regulated than standard bank loans. You must read the fine print. Look for the multiplier. This tells you how much you pay back. Look for hidden fees. There are usually origination fees. There are also appraisal fees.

Ask the company to explain the worst-case scenario. Ask them what happens if the market crashes. Most agreements protect you here. If the house value drops, you usually do not owe more than the house is worth. Some agreements even share the loss. This protection is a key feature. It adds a layer of safety for the homeowner.

Final Words

Your home is a powerful financial tool. A home equity agreement is a unique key to unlock that power. It offers cash without debt. It offers freedom from monthly payments. It provides a lifeline for those who cannot refinance. You share your future profits to fix your current problems. It is a trade of time for money.

Weigh the costs against the benefits. Think about your long-term plans. Talk to your family. If you decide to sell your home entirely to access all equity, remember that Bama Home Buyer is an option. Make the choice that helps you sleep better at night. Your financial health is the most important goal.